All You Need

to Know About Hainan QFLP Measures

千呼萬喚始出來:全方位解析海南QFLP制度

On October 10, 2020, Hainan Local Financial Supervision and Administration (the “Hainan FSA”), Hainan Administration for Market Regulation, Haikou Central Sub-branch of the People's Bank of China and Hainan Branch of China Securities Regulatory Commission jointly promulgated the Interim Measures of Hainan Province on Domestic Equity Investment for Qualified Foreign Limited Partners (the “Hainan QFLP Measures” or the “Measures”). As a significant scheme of financial reform and innovation in Hainan Province, the Measures contain several highlights, including: lifting the threshold on formation and registration of foreign-invested equity investment management enterprises (“Hainan QFLP PFMs”) and foreign-invested equity investment enterprises (“Hainan QFLP Funds”, collectively, the “Hainan QFLP Entities”), implementing nondiscriminatory treatment for both domestic and foreign investors, and regulating the investment scope of Hainan QFLP Funds with a negative list, all of which have laid a solid institutional foundation for attracting foreign capital into Hainan PE/VC market.

2020年10月10日,海南省地方金融監(jiān)督管理局(“海南省金融管理局”)、海南省市場(chǎng)監(jiān)督管理局、中國人民銀行海口中心支行、中國證券監(jiān)督管理委員會(huì)海南監(jiān)管局(合稱“海南省金融管理局等四部門”)聯(lián)合印發(fā)了《海南省關(guān)于開展合格境外有限合伙人(QFLP)境內(nèi)股權(quán)投資暫行辦法》(“海南QFLP制度”)。作為海南金融改革創(chuàng)新的一項(xiàng)重要制度,海南QFLP制度亮點(diǎn)頻出,包括但不限于對(duì)外商投資股權(quán)投資管理企業(yè)(“海南QFLP基金管理企業(yè)”)及外商投資股權(quán)投資企業(yè)(“海南QFLP基金”,與海南QFLP基金管理企業(yè)合稱為“海南QFLP企業(yè)”)的設(shè)立注冊(cè)不設(shè)最低準(zhǔn)入門檻、內(nèi)外資實(shí)行無差別待遇、對(duì)海南QFLP基金投資范圍實(shí)行負(fù)面清單管理等,為吸引境外資本投資海南PE/VC市場(chǎng)奠定了堅(jiān)實(shí)的制度基礎(chǔ)。

Based on Jingtian & Gongcheng Investment Fund and Asset Management Team’s ten years of experience with QFLP pilot schemes in all thirteen regions (e.g., in our role as member of the QFLP expert review committees, adviser to relevant financial services offices on the drafting or amendment of QFLP measures and legal counsel to our clients in applying for QFLP pilot status, including clients among the first batch of Hainan QFLP Entities), this article sets out to analyze the Hainan QFLP Measures from the following six aspects, (i) the background of the Hainan QFLP Measures, (ii) the main models of Hainan QFLP Funds, (iii) formation and operation supervision of Hainan QFLP Entities, (iv) investment scope of Hainan QFLP Funds, (v) preferential policies available to Hainan QFLP Entities, and (vi) a comparison chart of the Hainan QFLP Measures and QFLP pilot schemes in other popular regions.

本文將結(jié)合競(jìng)天公誠投資基金與資產(chǎn)管理團(tuán)隊(duì)對(duì)各地QFLP試點(diǎn)制度的多年實(shí)踐經(jīng)驗(yàn)(包括近期協(xié)助數(shù)家投資機(jī)構(gòu)申請(qǐng)首批海南QFLP企業(yè)的實(shí)務(wù)經(jīng)驗(yàn)),從海南QFLP制度的出臺(tái)背景、海南QFLP基金設(shè)立的主要模式、海南QFLP企業(yè)的設(shè)立注冊(cè)及事后監(jiān)管、海南QFLP基金的投資范圍、海南QFLP企業(yè)可享受的優(yōu)惠政策、海南QFLP制度與其他熱門地區(qū)QFLP試點(diǎn)制度比較等六個(gè)層面來解析海南QFLP制度。

I.

Background

of the Hainan QFLP Measures

海南QFLP制度的出臺(tái)背景

Shanghai took the lead in establishing a local pilot scheme for foreign equity investment in 2010. Subsequently, other regions such as Beijing, Tianjin, Shenzhen, Qingdao, Chongqing, Guizhou (Guiyang Comprehensive Bonded Zone), Fujian Pingtan, Zhuhai, Guangzhou, Suzhou and Xiamen followed suit and have established their respective local QFLP pilot scheme.

上海于2010年率先創(chuàng)立了地方性的外商投資股權(quán)投資試點(diǎn)制度。隨后,北京、天津、深圳、青島、重慶、貴州(貴陽綜合保稅區(qū))、福建平潭、珠海、廣州、蘇州、廈門等地均亦出臺(tái)地方QFLP試點(diǎn)制度。

In order to actively promote the development of the Hainan Free Trade Port (the “Port”), the Hainan FSA and other competent government authorities drew on other pilot regions’ experience in QFLP pilot schemes, and implemented the much attractive Measures, which is easier, more convenient, and more responsive to market needs:

為積極推進(jìn)海南自由貿(mào)易港建設(shè),加快吸引境外資本落地海南,海南省金融管理局及其他相關(guān)部門結(jié)合各地已出臺(tái)的QFLP試點(diǎn)制度及市場(chǎng)需求,積極推進(jìn)更加寬松、便利、順應(yīng)市場(chǎng)需求的海南QFLP制度落地:

?

On June 1, 2020, the

State Council issued the

Overall Plan for the Construction of the Hainan Free Trade Port (the “Overall Plan”).[1] Pursuant to the Overall Plan, cross-border

capital flows within the Hainan Free Trade Port are free and flexible. The

Hainan Free Trade Port shall adhere to the principle of providing financial

services to real economy, with its focus on trade and

investment liberalization and facilitation. Restriction on capital account shall be opened up in several stages,

and free and flexible capital flows between the port and foreign areas will be

promoted in an orderly manner.

2020年6月1日,國務(wù)院印發(fā)《海南自由貿(mào)易港建設(shè)總體方案》(“《總體方案》”)。其中規(guī)定:跨境資金流動(dòng)自由便利。堅(jiān)持金融服務(wù)實(shí)體經(jīng)濟(jì),重點(diǎn)圍繞貿(mào)易投資自由化便利化,分階段開放資本項(xiàng)目,有序推進(jìn)海南自由貿(mào)易港與境外資金自由便利流動(dòng)。

? On June 8, 2020, at the press conference held by the State Council Information Office for introduction of the Overall Plan, Mr. Pan Gongsheng, Vice Governor of the People’s Bank of China and Director of the State Administration of Foreign Exchange, introduced the relevant financial policies to support construction of the Hainan Free Trade Port. In terms of cross-border direct investments, the Port will implement two pilot schemes, namely, the QFLP (qualified foreign limited partner) scheme and the QDLP (qualified domestic limited partner) scheme.

2020年6月8日,央行副行長(zhǎng)、國家外匯管理局局長(zhǎng)潘功勝在國務(wù)院新聞辦公室就《總體方案》有關(guān)情況舉行的新聞發(fā)布會(huì)上介紹了支持海南自由貿(mào)易港建設(shè)的相關(guān)金融政策,在跨境直接投資方面,海南自由貿(mào)易港內(nèi)將試行QFLP(合格境外有限合伙人)和QDLP(合格境內(nèi)有限合伙人)兩項(xiàng)制度。

? On October 10, 2020, the Hainan QFLP Measures were issued, and meanwhile the Hainan FSA and other government authorities have been actively working towards the issuance of pilot QDLP measures.

2020年10月10日,海南省金融管理局等四部門聯(lián)合出臺(tái)了海南QFLP制度,并在積極爭(zhēng)取海南QDLP制度的落地。

II.

Main

Models of Hainan QFLP Fund Formation

海南QFLP基金設(shè)立的主要模式

Pursuant to the Measures, Hainan QFLP Entities consist of Hainan QFLP PFMs and Hainan QFLP Funds:

根據(jù)海南QFLP制度的規(guī)定,海南QFLP企業(yè)包括海南QFLP基金管理企業(yè)及海南QFLP基金:

? Hainan QFLP PFMs: enterprises that are duly formed pursuant to the applicable laws and invested by foreign enterprises or individuals, operate within Hainan Province, and mainly engage in the business of forming or managing Hainan QFLP Funds.

海南QFLP基金管理企業(yè):在海南省依法由境外的企業(yè)或自然人參與投資設(shè)立并實(shí)際經(jīng)營(yíng)的,以發(fā)起設(shè)立或受托管理外商投資股權(quán)投資企業(yè)為主要經(jīng)營(yíng)業(yè)務(wù)的企業(yè)。

? Hainan QFLP Funds: enterprises that are duly formed by foreign enterprises or individuals (or alternatively, formed wholly or partially with investments from such foreign enterprises or individuals), operate within Hainan Province, and raise funds in a non-public manner from domestic and/or foreign investors for re-investment in securities of domestic non-public companies.

海南QFLP基金:在海南省依法由境外的企業(yè)或自然人參與投資或設(shè)立并實(shí)際經(jīng)營(yíng)的,以非公開方式向境內(nèi)外投資者募集資金,投資于境內(nèi)非公開交易的企業(yè)股權(quán)的企業(yè)。

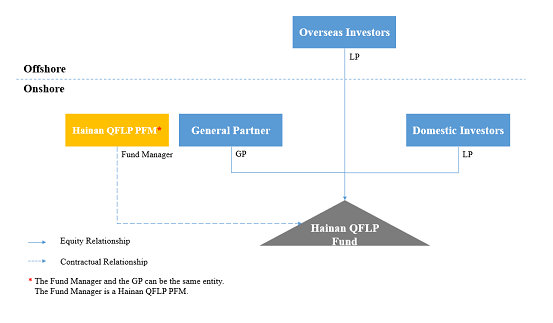

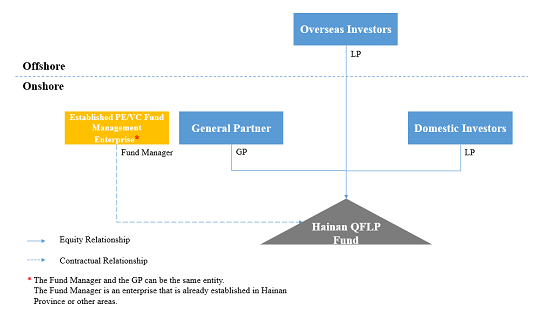

As one of the highlights, the Measures impose nondiscriminatory treatment on both domestic and foreign investors, featuring two business models (i.e., “domestic manager managing foreign capital” and “foreign manager managing domestic capital”), and impose the same requirements on both domestic and foreign-invested Hainan QFLP PFMs. Fund promoters may sponsor and form Hainan QFLP Funds by the following models:

作為亮點(diǎn)之一,海南QFLP制度對(duì)內(nèi)外資實(shí)行無差別待遇,允許“內(nèi)資管外資”和“外資管內(nèi)資”的業(yè)務(wù)模式,且對(duì)內(nèi)資、外資基金管理企業(yè)的要求一致。基金發(fā)起人可以通過下述模式在海南省發(fā)起設(shè)立海南QFLP基金:

Model 1: A fund promoter with foreign investment can newly establish a Hainan QFLP PFM, which can form one or more Hainan QFLP Fund(s) in Hainan Province;

模式1:對(duì)于包含外資成分的基金發(fā)起人,可在海南新設(shè)海南QFLP基金管理企業(yè),并由海南QFLP基金管理企業(yè)在海南發(fā)起設(shè)立一支或數(shù)支海南QFLP基金;

Model 2: A PE/VC fund management enterprise that is already established in Hainan Province or other regions within China (either domestic-funded or foreign-funded) may directly form one or more Hainan QFLP Fund(s) in Hainan Province.

模式2:對(duì)于已在海南或其他地區(qū)設(shè)立的PE/VC基金管理企業(yè)(內(nèi)資、外資均可),可直接在海南發(fā)起設(shè)立一支或數(shù)支海南QFLP基金。

The first Hainan QFLP Fund (Hainan Bocom International Sci-Tech Shengxing Equity Investment Partnership (L.P.)) adopted the structure of Model 2, with a fund management enterprise registered with the Asset Management Association of China (the “AMAC”) (i.e., Bank of Communications International Equity Investment Management (Shenzhen) Co., Ltd.) acting as its general partner and fund manager. The AUM is about USD100 million.

首支落地的海南QFLP基金(海南交銀國際科創(chuàng)盛興股權(quán)投資合伙企業(yè)(有限合伙))采用了模式2的結(jié)構(gòu),由已在中國證券投資基金業(yè)協(xié)會(huì)(“基金業(yè)協(xié)會(huì)”)登記的基金管理企業(yè)(交銀國際股權(quán)投資管理(深圳)有限公司)擔(dān)任該基金的普通合伙人及基金管理人,基金管理規(guī)模約為1億美元。

In addition, the Measures also specify that Hainan QFLP PFMs may form or manage ordinary PE/VC funds (i.e., non-QFLP funds) in Hainan Province and other regions.[2]

此外,海南QFLP制度還明確規(guī)定,海南QFLP基金管理企業(yè)可在海南及其他地區(qū)發(fā)起設(shè)立/管理一般類的PE/VC基金。

III.

Formation,

Registration and Post-Registration Supervision of Hainan QFLP Entities

海南QFLP企業(yè)的設(shè)立注冊(cè)及事后監(jiān)管

1.

Highlights

of Policies for Formation and Registration of Hainan QFLP Entities

海南QFLP企業(yè)設(shè)立注冊(cè)的政策亮點(diǎn)

Compared with the QFLP pilot schemes in other regions, the Measures are easier and more convenient in terms of formation and registration of Hainan QFLP Entities:

與其他地區(qū)的QFLP試點(diǎn)制度相比,海南QFLP制度在海南QFLP企業(yè)的設(shè)立注冊(cè)方面更加寬松及便利:

(1) The Measures explicitly specify that there is no threshold requirement for formation and registration of Hainan QFLP PFMs and Hainan QFLP Funds, including no requirement regarding minimum registered capital or capital commitment, currency of capital contribution, initial contribution ratio, monetary contribution ratio, and no time limit for such contribution, etc.

明確規(guī)定對(duì)海南QFLP基金管理企業(yè)及海南QFLP基金的設(shè)立注冊(cè)均不設(shè)最低準(zhǔn)入門檻,包括:對(duì)企業(yè)的最低注冊(cè)資本或認(rèn)繳出資金額、出資幣種、首次出資比例、貨幣出資比例、出資期限等均不加限制。

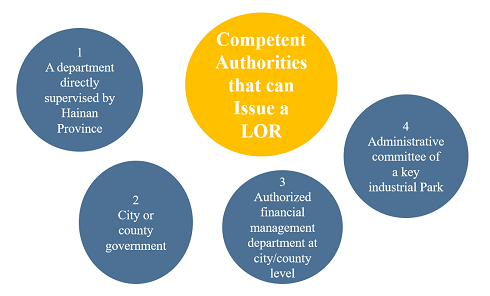

(2) The Measures further simplify the formation and registration process for Hainan QFLP Entities and replace the Joint Conference[3] approval mechanism (for QFLP pilot scheme qualifications) with a “Letter of Recommendation” mechanism, that is, as long as any competent authority, including any department under direct supervision of Hainan Province, any municipal or county government (or authorized financial management department at the same level), or administrative committee of a key industrial park, issues a Letter of Recommendation to the Hainan Administration for Market Regulation and copies the same to the Hainan FSA, the Hainan Administration for Market Regulation shall register the relevant Hainan QFLP PFM or Hainan QFLP Fund.

進(jìn)一步簡(jiǎn)化海南QFLP基金管理企業(yè)/QFLP基金的設(shè)立注冊(cè)流程,取消了聯(lián)席會(huì)議審核試點(diǎn)資格的制度,并采用“推薦函”形式予以代替,即:海南省直相關(guān)職能部門、市(縣)人民政府(或授權(quán)同級(jí)金融管理單位)、重點(diǎn)產(chǎn)業(yè)園區(qū)管委會(huì)中的任意一個(gè)主體為相關(guān)的海南QFLP基金管理企業(yè)/QFLP基金向海南省市場(chǎng)監(jiān)督管理局出具推薦函并抄送海南省金融管理局后,海南省市場(chǎng)監(jiān)督管理局將予以登記注冊(cè)。

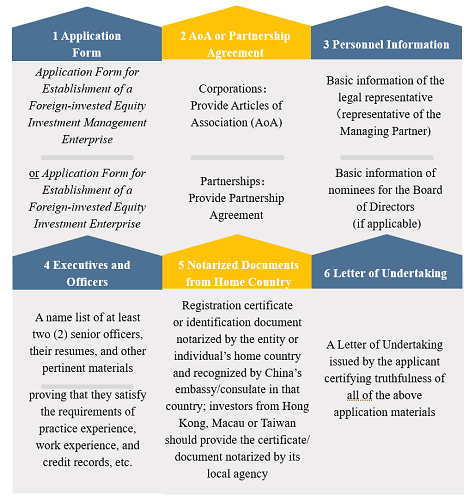

The relevant materials that Hainan QFLP Entities shall file to the competent authorities when applying for a Letter of Recommendation include:

海南QFLP企業(yè)申請(qǐng)推薦函需向主管部門提交的相關(guān)資料包括:

2.

Qualification

Requirements for Senior Officers

高級(jí)管理人員的資質(zhì)要求

In accordance with the Hainan QFLP Measures, Hainan QFLP PFMs shall have at least two senior officers satisfying all of the following conditions. It should be noted that the requirements of the Hainan QFLP Measures in respect of practice experience, work experience, credit records, and other aspects of senior officers are higher than the general requirements of the AMAC for senior officers, and enterprises applying for Hainan QFLP qualification need to make a reasonable judgment on whether such requirements can be satisfied. Said senior officers should be:

根據(jù)海南QFLP制度,海南QFLP基金管理企業(yè)應(yīng)當(dāng)具有至少2名滿足下列全部條件的高級(jí)管理人員。需注意,海南QFLP制度在高級(jí)管理人員的從業(yè)經(jīng)驗(yàn)、任職經(jīng)歷、誠信記錄等方面的要求高于基金業(yè)協(xié)會(huì)對(duì)高級(jí)管理人員的一般要求,申請(qǐng)企業(yè)需合理判斷自身是否能滿足該等要求。

(a)

With more than five

years of experience in equity investment or equity investment management

business;

有5年以上從事股權(quán)投資或股權(quán)投資管理業(yè)務(wù)的經(jīng)歷;

(b)

With more than two

years of experience in holding senior officer positions;

有2年以上高級(jí)管理職務(wù)任職經(jīng)歷;

(c)

With experience in

engaging in equity investment in China or working experience in a financial

institution in China; and

有在境內(nèi)從事股權(quán)投資經(jīng)歷或在境內(nèi)金融機(jī)構(gòu)從業(yè)經(jīng)驗(yàn);及

(d)

With no record on violation of laws or outstanding

economic dispute litigation in the

last five years, and his/her personal credit record is good.

在最近5年內(nèi)無違規(guī)記錄或尚在處理的經(jīng)濟(jì)糾紛訴訟案件,且個(gè)人信用記錄良好。

The definition of “senior officers” includes: directors, supervisors, general manager, deputy general manager, chief financial officer, board secretary of a corporate-type enterprise, and other personnel specified in the corporate’s articles of association; general partners of a partnership-type enterprise and other personnel specified in the limited partnership agreement. Where a general partner of a partnership-type enterprise is a legal entity, the senior officers of such legal entity shall also be deemed senior officers of the relevant Hainan QFLP PFMs.

高級(jí)管理人員包括:公司型企業(yè)的董事、監(jiān)事、總經(jīng)理、副總經(jīng)理、財(cái)務(wù)負(fù)責(zé)人、董事會(huì)秘書和公司章程約定的其他人員,以及合伙型企業(yè)的普通合伙人和合伙協(xié)議約定的其他人員。合伙型企業(yè)的普通合伙人為法人機(jī)構(gòu)的,則該機(jī)構(gòu)的高級(jí)管理人員一并視為高級(jí)管理人員。

3.

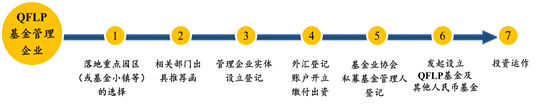

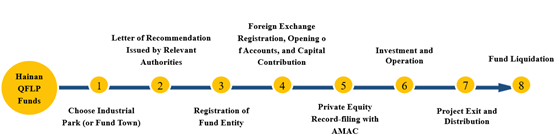

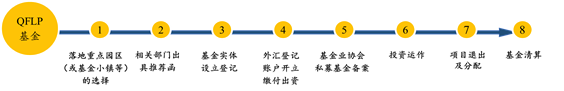

Formation and Operation Procedures

of Hainan QFLP Entities

海南QFLP企業(yè)的設(shè)立及運(yùn)營(yíng)流程

During the formation and operation of Hainan QFLP Entities, the following matters shall be noted:

在設(shè)立及運(yùn)營(yíng)海南QFLP企業(yè)的過程中,需重點(diǎn)關(guān)注下列事宜:

?

Industrial

Park: As

of now, the Hainan

Free Trade Port has set

up following 11 key parks. These parks cover three major industries: modern services, advanced technologies, and tourism.

落地園區(qū):海南自由貿(mào)易港目前設(shè)立了下述11個(gè)重點(diǎn)園區(qū),園區(qū)產(chǎn)業(yè)類型涵蓋現(xiàn)代服務(wù)業(yè)、高新技術(shù)產(chǎn)業(yè)和旅游業(yè)三大領(lǐng)域。

-

Modern

Service Industrial Park: Haikou Jiangdong New Area, Haikou Integrated Free Trade

Zone, Sanya Central Business District, Boao Lecheng International Medical

Tourism Pilot Zone.

現(xiàn)代服務(wù)業(yè)園區(qū):海口江東新區(qū)、海口綜合保稅區(qū)、三亞中央商務(wù)區(qū)、博鰲樂城國際醫(yī)療旅游先行區(qū)。

-

High-tech

Industrial Park: Yangpu Economic Development Zone, Haikou National Hi-tech Industrial

Development Zone, Sanya Yazhou Bay Science and Technology City, Wenchang

International Aerospace City, Hainan Ecological Software Park and Haikou

Fullsing Internet Industrial Park.

高新技術(shù)產(chǎn)業(yè)園區(qū):洋浦經(jīng)濟(jì)開發(fā)區(qū)、海口國家高新技術(shù)產(chǎn)業(yè)開發(fā)區(qū)、三亞崖州灣科技城、文昌國際航天城、海南生態(tài)軟件園和復(fù)興城互聯(lián)網(wǎng)信息產(chǎn)業(yè)園。

-

Tourism

Park:

Hainan Lingshui Li’an International Education Innovation Pilot Zone.

旅游業(yè)園區(qū):陵水黎安國際教育創(chuàng)新試驗(yàn)區(qū)。

? Letter of Recommendation: Hainan Administration for Market Regulation is responsible for the registration of fund enterprises. In addition to Hainan QFLP Entities, the other fund management enterprises/fund enterprises formed in Hainan Province also need to obtain a letter of recommendation issued by a relevant functional department under direct supervision of the provincial government or by the city/county government, to Hainan Administration for Market Regulation, before going through the registration procedures. This fully demonstrates the advantage of the Hainan QFLP Measures of treating domestic and foreign investors equally without discrimination, which means the same (or even easier) preposing procedures will apply to Hainan QFLP Entities, compared with other domestic fund management enterprises/fund enterprises.

推薦函:海南省市場(chǎng)監(jiān)督管理局負(fù)責(zé)基金企業(yè)的注冊(cè)登記。除海南QFLP企業(yè)外,海南省設(shè)立的其他基金管理類企業(yè)/基金類企業(yè)辦理注冊(cè)登記程序前,亦需由省直屬相關(guān)職能部門或市縣人民政府向海南省市場(chǎng)監(jiān)督管理局出具推薦函,這充分體現(xiàn)了海南QFLP制度內(nèi)外資無差別待遇的制度優(yōu)越性,即海南QFLP企業(yè)與其他內(nèi)資基金管理類企業(yè)/基金類企業(yè)適用同樣(或口徑更寬松)的前置推薦函流程。

? Registration: Hainan Administration for Market Regulation simplifies the offline formation and registration process and shortens the time required for the formation, that is, as long as all required materials are submitted, an enterprise may directly apply for a business license from Hainan Administration for Market Regulation after completing online approval of its name and examination of the submitted materials.

注冊(cè)登記:海南省市場(chǎng)監(jiān)督管理局簡(jiǎn)化了線下設(shè)立登記流程并縮短了工商設(shè)立所需的時(shí)間,即:在材料齊備的情況下,完成線上名稱核準(zhǔn)及材料審核通過后,可直接向海南省市場(chǎng)監(jiān)督管理局申領(lǐng)營(yíng)業(yè)執(zhí)照。

? Foreign Exchange Registration and Opening of Accounts: The applicant shall entrust a qualified commercial bank to handle foreign exchange registration and open of accounts (including capital account, special account for fund raising and settlement, escrow account, etc.)

外匯登記及賬戶開立:需委托有資質(zhì)的商業(yè)銀行辦理外匯登記、開立資本金賬戶、募集結(jié)算資金專用賬戶、托管賬戶等。

? Investment Operations: (a) Where there is any change in the enterprise name, business scope, shareholders or partners, capital commitment or capital contribution, time limit for contribution, organization form, senior officers, etc., of Hainan QFLP Entities, the entity’s registration shall be changed accordingly pursuant to the relevant regulations; and (b) Hainan QFLP Entities shall report the following significant matters in their investment operations on a semi-annual basis to the Hainan FSA: information on operation of investment projects, amendments to important legal documents, other matters required by the Hainan FSA, etc.

投資運(yùn)作:(a)海南QFLP企業(yè)的企業(yè)名稱、經(jīng)營(yíng)范圍、股東或合伙人、認(rèn)繳或?qū)嵗U出資金額、繳付期限、企業(yè)組織形式、高級(jí)管理人員等發(fā)生變更時(shí),需按照相關(guān)規(guī)定辦理變更登記手續(xù);(b)海南QFLP企業(yè)需每半年向海南省金融管理局報(bào)告半年投資運(yùn)作中的下述重大事項(xiàng):投資項(xiàng)目運(yùn)作情況、重要法律文件的修改、海南省金融管理局要求的其他事項(xiàng)等。

? Project Realization and Distribution: Hainan QFLP Entities may distribute profits, liquidate, or withdraw its capital in accordance with the articles of association or the limited partnership agreement. Hainan QFLP Entities shall submit the relevant evidentiary materials to the bank for outward remittance of profits, dividends, and bonuses; and it may only make outward remittance upon examination and approval. Communicating with the foreign exchange regulatory bank in advance to confirm the requirements of the specific evidentiary materials is recommended.

項(xiàng)目退出及分配:海南QFLP企業(yè)可按照公司章程或合伙協(xié)議的約定進(jìn)行利潤(rùn)分配或清算撤資。海南QFLP企業(yè)進(jìn)行利潤(rùn)、股息、紅利匯出時(shí),需向銀行提交相關(guān)證明材料,經(jīng)審核通過后方可匯出境外。具體證明材料,建議事先與外匯監(jiān)管銀行溝通確認(rèn)。

IV. Investment Scope of Hainan QFLP Funds

The investment scope of Hainan QFLP Funds is regulated by a negative list, which means the Hainan QFLP Funds may carry out businesses not covered by the negative list. In accordance with Article 21 of the Hainan QFLP Measures, the negative list prohibits investments of Hainan QFLP Funds in the following areas:

海南QFLP基金的投資范圍采取負(fù)面清單管理模式,海南QFLP基金可開展負(fù)面清單以外的業(yè)務(wù)。根據(jù)海南QFLP制度第21條的規(guī)定,海南QFLP基金投資范圍的負(fù)面清單包括:

(1)

Invest in fields where

foreign investment is prohibited;

在國家禁止外商投資的領(lǐng)域投資;

(2)

Trade in stocks and corporate bonds in the secondary market;[4]

二級(jí)市場(chǎng)股票和企業(yè)債券交易;

(3)

Trade in futures and

other financial derivatives;

期貨等金融衍生品交易;

(4)

Invest in non-self-use

real estate;

投資于非自用不動(dòng)產(chǎn);

(5)

Misappropriate

non-self-owned capital to make investment;

挪用非自有資金進(jìn)行投資;

(6)

Provide loans or

guarantees to non-investee enterprises; and

向非被投企業(yè)提供貸款或擔(dān)保;

(7)

Engage in other

activities prohibited by the laws and/or regulations.

國家法律法規(guī)禁止從事的其他事項(xiàng)。

V.

Preferential

Policies Available to Hainan QFLP Entities

海南QFLP企業(yè)可享受的優(yōu)惠政策

Eligible Hainan QFLP Entities and their senior officers and employees may, in accordance with the laws, enjoy preferential policies on enterprise income tax, individual income tax, and talent awards (including talent settlement, purchase of car and house, employment of spouse, enrollment of children, medical care and housing support) in the Hainan Free Trade Port. Hainan QFLP Entities that have settled down in key industrial parks may further enjoy preferential policies of the area where the park is located. For details of the preferential policies, please refer to our previous article – Approaching Hainan Free Trade Port: Gathering of Government and Industry Experts to Escort Private Equity Investments in Hainan.[5]

符合條件的海南QFLP企業(yè)以及該等企業(yè)的高管人員及員工可依法享受海南自由貿(mào)易港有關(guān)企業(yè)所得稅、個(gè)人所得稅、人才獎(jiǎng)勵(lì)(含人才落戶、購車購房、配偶就業(yè)、子女入學(xué)、醫(yī)療和住房保障等)等優(yōu)惠政策。落戶在重點(diǎn)產(chǎn)業(yè)園區(qū)的海南QFLP企業(yè),還可進(jìn)一步享受重點(diǎn)產(chǎn)業(yè)園區(qū)落地的地方優(yōu)惠政策,具體優(yōu)惠政策介紹可參見我們此前發(fā)布的《海南自貿(mào)港零距離:政府及行業(yè)專家云集,共為私募基金投資海南保駕護(hù)航。

The Hainan QFLP Measures clearly stipulate that Hainan QFLP Entities will be actively promoted to be included in the catalogue of encouraged industries in the Hainan Free Trade Port as provided in the Circular on Preferential Corporate Income Tax Policies for the Hainan Free Trade Port (Cai Shui [2020] No.31),[6] so that Hainan QFLP Entities may enjoy preferential enterprise income tax policies.[7]

海南QFLP制度明確規(guī)定,將積極推動(dòng)外商投資股權(quán)投資類企業(yè)納入《關(guān)于海南自由貿(mào)易港企業(yè)所得稅優(yōu)惠政策的通知》(財(cái)稅[2020]31號(hào))中規(guī)定的海南自由貿(mào)易港鼓勵(lì)類產(chǎn)業(yè)目錄,以便海南QFLP企業(yè)享受企業(yè)所得稅優(yōu)惠。

On September 1, 2020, the National Development and Reform Commission promulgated the Catalogue of Encouraged Industries in the Hainan Free Trade Port (2020 Version, Draft for Comment) (the “Draft”). Although the encouraged industries in Hainan Province as specified in the Draft do not include private equity funds and private equity fund management enterprises, the “development of a two-way open service system for cross-border investment and financing” as specified in Article 72 thereof leaves some room for QFLP funds, QDLP funds, and their fund management enterprises to be recognized as encouraged industries in Hainan Province. Given that the Catalogue of Encouraged Industries in the Hainan Free Trade Port and relevant detailed rules for such recognition have not been officially launched, it remains uncertain whether Hainan QFLP Funds, Hainan QDLP Funds, and their fund management enterprises can be recognized as encouraged industries in the Hainan Free Trade Port.

2020年9月1日,國家發(fā)展改革委員會(huì)發(fā)布了《海南自由貿(mào)易港鼓勵(lì)類產(chǎn)業(yè)目錄(2020年本,征求意見稿)》(“征求意見稿”),征求意見稿中已明確列舉的海南鼓勵(lì)類產(chǎn)業(yè)尚未包括私募投資基金/私募基金管理企業(yè),但其第72條規(guī)定的“跨境投融資雙向開放服務(wù)體系建設(shè)”為QFLP基金、QDLP基金及其基金管理企業(yè)被認(rèn)定為海南鼓勵(lì)類產(chǎn)業(yè)預(yù)留了一定的解釋空間。鑒于海南自由貿(mào)易港鼓勵(lì)類產(chǎn)業(yè)目錄和相關(guān)認(rèn)定細(xì)則尚未正式公布,海南QFLP基金、海南QDLP基金及其基金管理企業(yè)是否能被認(rèn)定為海南自由貿(mào)易港鼓勵(lì)類產(chǎn)業(yè),還有待進(jìn)一步觀察。

VI. Comparison of the Hainan

QFLP Measures with QFLP Pilot Measures in Other Popular Regions

海南QFLP制度與其他熱門地區(qū)QFLP試點(diǎn)制度比較

為方便廣大讀者進(jìn)一步比較海南QFLP制度與其他地區(qū)QFLP試點(diǎn)制度的區(qū)別,我們以上海、深圳的QFLP試點(diǎn)制度為基礎(chǔ),準(zhǔn)備了下述制度比較表:

|

Matters |

Hainan QFLP Measures 制度 |

Shanghai/Shenzhen QFLP Pilot Schemes |

|

Registered Capital 注冊(cè)資金 |

No restriction on the amount of registered capital and capital commitment of Hainan QFLP PFMs and Hainan QFLP Funds 對(duì)海南QFLP基金管理企業(yè)及海南QFLP基金的注冊(cè)資本及認(rèn)繳出資金額無限制 |

Shanghai and Shenzhen: ?

The registered capital (or capital commitment)

of a QFLP fund management enterprise shall be no less than USD 2 million; ?

The capital commitment

of a QFLP fund shall be no less than USD 15 million. |

|

No restriction on the ratio and time limit of initial capital

contribution to Hainan QFLP PFMs |

Shanghai and Shenzhen: More

than 20% of the registered capital (or capital

commitment) of a QFLP fund management enterprise

shall be paid in within three months of the issuance of its business license,

and the remainder shall be paid in within two years. |

|

|

No restriction on the amount of capital commitment from a single

investor of Hainan QFLP Funds |

Shanghai: Except

for the general partners, the capital contribution amount of each limited

partner of a Shanghai QFLP fund shall be no less than USD 1 million. |

|

|

Background

of Shareholders |

No restrictions on the background or qualifications of foreign

shareholders or partners of Hainan QFLP PFMs |

Shanghai: Foreign

investors of a Shanghai QFLP fund management enterprise shall satisfy all of

the following conditions: ?

Size of self-owned assets or assets managed by

the enterprise: In the last accounting year prior to the application, the

size of self-owned assets shall be no less than USD 500 million or the size

of assets managed by the enterprise shall be no less than USD 1 billion; ?

Governance Structure and Internal Control

System: The enterprise shall have a sound governance structure and a

comprehensive internal control system; it has not been punished by the

judicial authorities or relevant regulatory authorities in the past two

years; ?

Investment Experience: A foreign investor or

any of its affiliated entities shall have more than five years of relevant

investment experience; ?

Other conditions as required by the Joint

Conference. Shenzhen: Foreign

shareholders or partners of a Shenzhen QFLP fund management enterprise shall

satisfy at least one of the following conditions: ?

Size of self-owned assets or assets managed by

the enterprise: In the last accounting year prior to the application, the

size of self-owned assets (net assets) shall be no less than the equivalent

of USD 100 million or the size of assets managed shall be no less than the

equivalent of USD 200 million; ?

Financial License: The enterprise holds an

asset management license issued by the Hong Kong Securities and Futures

Commission (or any other financial regulatory authorities outside of mainland

China). |

|

No restrictions on the background or qualifications of the

domestic shareholders or partners of Hainan QFLP PFMs

|

Shenzhen: Domestic

shareholders or partners of a Shenzhen QFLP fund management enterprise shall satisfy

at least one of the following conditions: ?

Being licensed financial institutions approved

by Chinese financial regulatory authorities, including commercial banks,

securities companies, insurance company, trust company, financial leasing

enterprise, public fund management enterprise, etc., or primary subsidiaries

of said financial institutions in which they hold more than 50% of shares. ?

Being large-scale enterprises with key support

and introduction of the Shenzhen Municipal Party Committee and the Municipal

Government, and having self-owned assets (net assets) no less than RMB 500

million or managed assets no less than RMB 1 billion in the last accounting

year prior to the application; and having been profitable in the last three

consecutive years with an aggregate net profits of no less than RMB 60

million and an aggregate amount of paid-in tax of no less than RMB 18

million. |

VII.Summary

小結(jié)

The Hainan Free Trade Port’s soil of reform and innovation has bred an unprecedentedly easy QFLP policy, and the launch of Hainan’s QDLP scheme is gaining speed.[8] According to the news, domestic and foreign financial institutions and leading fund managers have gone to Hainan Province to seek cooperation, and many investment institutions are eager to start up their business in Hainan Province.[9] It is expected that, in the context of the gradually improved policy system and business environment, the institutional advantages of forming cross-border investment funds in Hainan will be fully unleashed, and various asset management institutions all over the world will be encouraged to gather in the Hainan Free Trade Port.

海南自由貿(mào)易港改革創(chuàng)新的土壤孕育出力度空前的寬松QFLP政策,且海南QDLP制度也在加速推進(jìn)中。據(jù)新聞報(bào)道,來自國內(nèi)外的金融機(jī)構(gòu)以及頭部基金已紛紛赴海南尋求合作,許多投資機(jī)構(gòu)也躍躍欲試希望開辟海南板塊。期待在逐步完善的政策體系及營(yíng)商環(huán)境中,海南跨境基金的制度優(yōu)勢(shì)能充分釋放,推動(dòng)全球各類資產(chǎn)管理機(jī)構(gòu)在海南自由貿(mào)易港集聚。

[1] Please refer to/請(qǐng)參見: http://www.gov.cn/zhengce/2020-06/01/content_5516608.htm.

[2] Article 6 of the Measures provide that foreign-invested equity

investment management enterprises may form RMB funds by offering directed

towards domestic investors that meet the relevant requirements.

海南QFLP制度第六條規(guī)定,外商投資股權(quán)投資管理企業(yè)可向符合相關(guān)規(guī)定的境內(nèi)投資者募集設(shè)立人民幣基金。

[3] The joint conference examination and approval process for pilot

scheme qualification (the “Joint

Conference”) means that in

pilot regions such as Shanghai and Shenzhen, formation of QFLP funds shall be

generally reviewed and approved on a case-by-case basis. Pursuant to this

procedure, the industrial and commercial registration process for the relevant

entity/fund will not be initiated until there is examination of the entity/fund

and approval from a joint conference (or working group), led by the local financial

affairs office and composed of a number of relevant regulatory departments

(including but not limited to the municipal financial affairs office, the

municipal commercial administrative department, the municipal market

supervision and administration department, the municipal development and reform

commission, the municipal foreign exchange administration bureau, and the

municipal finance bureau).

聯(lián)席會(huì)議審核試點(diǎn)資格的制度系指,在上海、深圳等試點(diǎn)地區(qū),設(shè)立QFLP基金通常按“一事一批”的原則審議,即由地方金融辦牽頭并由多個(gè)相關(guān)監(jiān)管部門(包括但不限于市級(jí)金融辦、市級(jí)商務(wù)主管部門、市市場(chǎng)監(jiān)督管理部門、市發(fā)展改革委員會(huì)、市外匯局、市財(cái)政局等)共同組成的聯(lián)席會(huì)議(或工作小組)審核通過后,方可啟動(dòng)相關(guān)實(shí)體的工商設(shè)立登記程序。

[4] Hainan QFLP Funds may invest in the trading of stocks and corporate

bonds in the secondary market recognized by the Hainan Local Financial

Supervision and Administration, the Hainan Regulatory Administration of the

China Securities Regulatory Commission, the Haikou Central Sub-branch of the

People’s Bank of China, the

Hainan Administration for Market Regulation and other administrative

departments, which leaves certain room for the investment of the Hainan QFLP

Funds in the stocks of listed companies and the trading of corporate bonds.

海南QFLP基金可投資經(jīng)海南省地方金融監(jiān)督管理局、中國證券監(jiān)督管理委員會(huì)海南監(jiān)管局、中國人民銀行海口中心支行、海南省市場(chǎng)監(jiān)督管理局等管理部門認(rèn)可的二級(jí)市場(chǎng)股票和企業(yè)債券交易,即給海南QFLP基金投資上市公司股票以及進(jìn)行企業(yè)債券交易預(yù)留了一定空間。

[5] Please refer to/請(qǐng)參見: http://mp.weixin.qq.com/s/UTemw6WLgzw7HWKGbGkTzQ.

[6] Please refer to/請(qǐng)參見: http://www.chinatax.gov.cn/chinatax/n810341/n810755/c5153881/content.html.

[7] The catalogue of encouraged industries in the Hainan Free Trade

Port includes The Guiding Catalogue for the Adjustment of

Industrial Structure (2019 Edition), The Catalogue of Encouraged

Industries for Foreign Investment (2019 Edition) and the Catalogue of Newly

Added Encouraged Industries in the Hainan Free Trade Port.

海南自由貿(mào)易港鼓勵(lì)類產(chǎn)業(yè)目錄包括《產(chǎn)業(yè)結(jié)構(gòu)調(diào)整指導(dǎo)目錄(2019年版)》、《鼓勵(lì)外商投資產(chǎn)業(yè)目錄(2019年版)》和海南自由貿(mào)易港新增鼓勵(lì)類產(chǎn)業(yè)目錄。

[8] Mr. Shen Danyang, vice-governor of Hainan Province, said at 2020

Jinniu Asset Management Forum organized by the China Securities Journal on

August 22, 2020, that Hainan Province is actively striving to launch the pilot

program of QDLP, and speeding up attracting and gathering top international

asset management institutions. Efforts are being made to explore ways to relax

the pilot quota for a single fund management enterprise and the quota for a

single investment project, and further clarify the scope of foreign investment

of the funds. In terms of additional quota issuance, settlement of

institutions, talent gathering, and other aspects, the government will

accelerate the construction of a policy system and business environment more

favorable for the development of global asset management institutions, and

promote the gathering of various global asset management institutions in the

Hainan Free Trade Port, so as to better meet the needs of investors for

diversified global asset allocation.

海南省副省長(zhǎng)沈丹陽于2020年8月22日在中國證券報(bào)社主辦的“2020金牛資產(chǎn)管理論壇”上表示,海南正在積極爭(zhēng)取QDLP(合格境內(nèi)有限合伙人)試點(diǎn)落地,加快吸引和集聚一批國際頂級(jí)資產(chǎn)管理機(jī)構(gòu)。探索放寬單家基金管理企業(yè)的試點(diǎn)額度和單個(gè)投資項(xiàng)目的額度限制,進(jìn)一步明確基金在境外的投資范圍。在額度增發(fā)、機(jī)構(gòu)落戶和人才集聚等方面,加快構(gòu)建更有利于全球資產(chǎn)管理機(jī)構(gòu)發(fā)展的政策體系和營(yíng)商環(huán)境,推動(dòng)全球各類資產(chǎn)管理機(jī)構(gòu)在海南自由貿(mào)易港集聚,更好的滿足投資者全球資產(chǎn)多元配置的需求。

[9] Please refer to/請(qǐng)參見: Hainan’s Financial Industry Opening up! Bring New Investment Opportunities for Global Enterprises (《海南金融業(yè)大開;放!為全球企業(yè)帶來投資新機(jī)遇》), www.ifeng.com.cn/c/7zKX2LZ4Qtf.

網(wǎng)站地圖|免責(zé)條款|聯(lián)系我們|網(wǎng)站支持IPV6

版權(quán)所有@海南省委金融委員會(huì)辦公室

主辦:海南省委金融委員會(huì)辦公室????瓊ICP備19000790號(hào)????聯(lián)系電話:0898-65358631

政府網(wǎng)站標(biāo)識(shí)碼:4600000063  瓊公網(wǎng)安備 46010802000433號(hào)

瓊公網(wǎng)安備 46010802000433號(hào)